High costs and limited access in some parts of the country can keep people from getting needed health care.

Kansas and Missouri are below average when it comes to the cost and quality of Medicare coverage.

That’s according to a new scorecard from The Commonwealth Fund that looks at how seniors are faring under the government health insurance program that covers one in five Americans.

The report, released on the second day people could sign up for 2026 Medicare benefits, assessed 50 states and Washington, D.C. Researchers considered access to care; quality of care; cost and affordability; and population health.

Overall, Kansas ranked 27th and Missouri ranked 34th.

Medicare, which is marking its 60th anniversary, covers hospital stays and doctor visits for 69 million Americans, including most people aged 65 and older and younger people with long-term disabilities. The program also covers prescription drugs for 56 million people.

Although Medicare is administered by the federal government and includes core benefits that are largely consistent across the country, some factors that vary by state influence how well it is working for beneficiaries.

These include the cost and availability of supplemental insurance plans and prescription coverage, how easy it is to find care close to home and the quality of that care.

“The report uncovers wide gaps in health care access, cost and quality,” Dr. Joseph Betancourt, president of The Commonwealth Fund, said during a conference call with reporters, “and clearly shows that Medicare, while a vital safety net for millions of Americans, is not working the same for everyone.”

Betancourt said he hopes policymakers use the report to identify gaps and adopt strategies to close them.

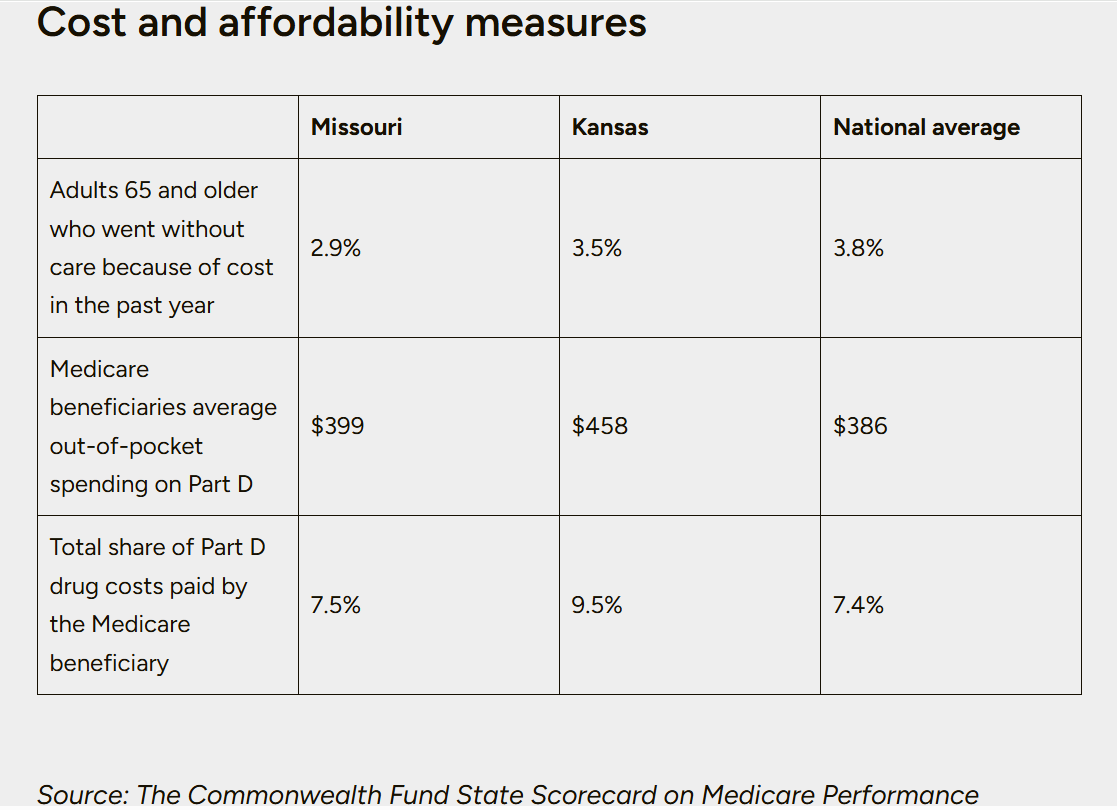

Missouri ranked 35th in cost and affordability, 32nd in access to care, 29th in quality of care and 28th in population health, according to The Commonwealth Fund’s scorecard. About 1.3 million Missourians — 21.5% of the state’s population — have Medicare.

Kansas ranked 50th on cost and affordability, 19th on both access to care and quality of care and 24th in population health, according to the scorecard. About 597,000 Kansans — 20% of the state’s population — have Medicare.

Only 13.7% of beneficiaries in Kansas receive a low-income subsidy, compared to 18% in Missouri and 20% nationwide. And 13.5% of older adults in Kansas have income at or near the federal poverty level, compared to 14.9% of older adults in Missouri and 18.9% nationwide.

tried and failed to push through a national health insurance program that would have provided government-sponsored insurance to people of all ages.

tried and failed to push through a national health insurance program that would have provided government-sponsored insurance to people of all ages.

Eventually, Medicare became a compromise to get basic coverage to older Americans. As health insurance was becoming more common, younger Americans were largely getting coverage through their employers, leaving retired people without insurance as they reached an age when they were more likely to need health care.

Medicare began as very basic coverage to pay the bill if someone ended up in the hospital. Later, coverage for outpatient care was added. Today, it has evolved even more.

Now when people turn 65, they can choose to enroll in a traditional Medicare plan or a Medicare Advantage plan that offers more coverage. Under traditional plans, the government pays insurance claims. But with Medicare Advantage, coverage comes through private insurance companies.

Medicare Advantage, which generally costs patients less upfront, has steadily become more popular in recent years. In 2010, only one quarter of Medicare participants chose a Medicare Advantage plan, but by 2025, the private plans had 51% of the national market. In Missouri, 54% of Medicare recipients are enrolled in private plans, compared to one-third of Kansans.

Medicare is divided into parts. Everyone gets Part A, which covers inpatient, hospital care. And most people get Part B, which covers outpatient care. Part D, which covers prescriptions, is optional and often paired with traditional Medicare coverage.

In addition to Part D, people who opt for traditional Medicare also usually pay for supplemental coverage, known as Medigap coverage, which fills in some of the services left out of Medicare coverage. Medicaid or an employer plan could also serve that purpose.

People who choose Medicare Advantage, also known as Part C, get everything rolled up together, including traditional coverage, plus other coverage, such as prescription, dental, vision and hearing. Advantage plans also sometimes include add-on services like gym memberships and transportation. And people on the plans often have to pay no or only minimal premiums.

The drawbacks of Medicare Advantage plans are that they can only be used with hospitals and physicians in an insurance plan’s network, and they are limited to certain geographic regions. And Medicare Advantage frequently requires patients to have specialty services pre-approved, known as prior authorization.

Finally, once a patient opts out of traditional Medicare in favor of Medicare Advantage, it may be difficult to switch back. That’s because in most states the insurance carriers that provide supplemental coverage aren’t required to accept patients once their initial Medicare enrollment is over.

“Insurance companies can look at your history and decide not to cover you,” said Louise Norris, health policy analyst with MedicareResources.org.

Medicare cost

While commercial insurance rates are expected to jump an average of 9% next year, and premiums for plans in the Affordable Care Act marketplace will shoot up even more, the premiums and out-of-pocket costs for Medicare recipients are expected to stay relatively stable.

Part A doesn’t cost beneficiaries anything, but Part B comes with a premium. Next year, those premiums are expected to be $206 a month, up from $185 in 2025, Norris said.

Average premiums for standalone Part D plans are expected to fall slightly to an average of $34.50, compared to $38.31 this year, according to projections from the Centers for Medicare and Medicaid Services. But the annual cap for out-of-pocket costs will increase to $2,100 from $2,000. And Part D drug plans also come with a deductible that patients must cover, and those will also go up slightly.

Meanwhile, the average monthly premium for Medicare Advantage plans, including plans with drug coverage, is expected to fall to $14 in 2026 from $16.40 this year. In Missouri average monthly premiums will drop to $8.56 in 2026, from $10.66 this year. And Kansas’ will increase to $10.11 in 2026, from $9.54 this year.

But prices and plans available vary by region. People can look to Medicare.gov and Medicare Plan Finder, both government websites, for help. And independent sites like MedicareResources.org also provide guides and information that can help.

For personal help or to ask questions, every state offers a federally funded health insurance assistance program, which provides free counselors who will help people sort through prescription needs and preferred providers to assess Medicare plans and choose the best option.

But even with help and advice, making a choice can be daunting, said Scott Miniea, executive director of Missouri SHIP, that state’s assistance program.

Missouri has so many choices for Medicare coverage, including 157 plans in 2026, people get “decision paralysis,” Miniea said. SHIP counselors can’t make the decision, but they can be sure people they work with know all the options and potential pitfalls.

Missouri’s SHIP program has the capacity to help about 50,000 people with Medicare choices each year. And the organization will provide most of that help during the seven-week open enrollment period running from Oct. 15 to Dec.7.

“It’s a crazy 36 days starting tomorrow,” Miniea said in an Oct. 14 phone call.

He doesn’t expect the federal government shutdown to have an immediate effect on people trying to enroll. But on Oct. 15, CMS said it would pause Medicare payments to doctors due to the shutdown.

For the first time this year, people will need an email address in order to enroll in Medicare, which could create an obstacle for some people without a computer or internet access, Miniea said.

He knows his organization won’t be able to help every Missourian who needs it. But other nonprofits also offer navigation services. And insurance brokers can provide assistance, too. But Miniea cautioned people to be aware of any conflicts of interest when seeking advice. Some brokers, for example, get paid by insurance plans for enrolling patients.